Lucid Motors is a Silicon Valley-based EV company that is disrupting the electric car industry. They’ve put together a high-performing and inexpensive vehicle — the Lucid Air — and they’re charging ahead to compete with Tesla.

Tesla has been eating the EV market since it introduced its first mass-market vehicle in 2017, and not just because of its electric vehicles, but for solar rooftops as well. In fact, some estimates suggest that Tesla will have more solar power installations than any other U.S. company by the end of 2018.

So how do Tesla and Lucid Motors plan on competing with each other?

Lucid Motors vs Tesla: Different Electric Vehicles for Different Markets

Lucid Motors offers two different vehicles, the Air and the Force, that are equipped with some incredibly impressive features. The Air is more or less a luxury sports sedan that can achieve 0-60 speeds in 2.5 seconds without any form of delay. It also has impressive aerodynamics to help it reach this speed, which is more than twice as fast as the Ferrari F12 Berlinetta. While this may not be an everyday vehicle for most people, it’s still competitively priced at $52,500 (before tax incentives).

Market Share

Anticipating the future takes a lot of work. It requires anticipating everything from employee departures to new product ideas, all while balancing the day-to-day operations that keep your company alive. Tesla Motors is asking investors to keep one foot in tomorrow’s world with their purchase, but are they forgetting about today?

Tesla’s stocks are down 30% since August 1st, while Lucid Motors has seen stocks increase by 55%. With an already struggling Tesla that cannot seem to make any progress toward profitability, should you still invest in this company? We think not.

As a business, Tesla is the epitome of the term ‘cash-strapped’. In a recent Bloomberg interview, CEO Elon Musk said, “We’re going to be in a far worse position than we thought in 12 months… We’ve got to pay back loans before we were planning on paying them. We thought we had 12 months before we needed to start doing this, but those 12 months have come and gone.”

So why would anyone want to invest in the company? There are several reasons; one of which is that Elon Musk has managed to create an aura around his name that makes people believe he will succeed no matter what. Another is that investors are not very involved in hard numbers, instead choosing to focus on the aura surrounding the CEO.

Lucid Motors, on the other hand, has little to no buzz around it. While they are working to build their own self-driving car technology for sale on the market, they have yet to release any substantial information on what this technology is. Investors are asking for more proof of their success before purchasing these stocks. But with Tesla’s success so far, it doesn’t seem likely that Lucid Motors will be able to duplicate this again anytime soon.

Tesla and Lucid Motors – Sales

Despite growing demand, Tesla’s sales report for the first quarter of 2017 was an unmitigated disaster. The company managed to sell just 13,000 cars in spite of massive safety recalls and half-hearted efforts at promoting the Model 3. This begs the question: is Tesla headed for bankruptcy?

Lucid Motors, in comparison, sold more than 1,200 cars in their best month ever—a number that would have made Tesla blush in its heyday. They are not even close to hitting their stride yet either; they are still developing their next prototype which they plan to unveil later this year. With the help of the Saudi Arabian government, Lucid Motors aims to sell its new sedan, the Lucid Air, starting in late 2018 for less than $100,000.

Several analysts have conceded that Tesla will be out of business within 5 years. The auto industry is an extremely competitive one and it is difficult for any company to break into—especially without a reliable product. Lucid Motors has not only produced an original car design but also has a fully functional factory already in place. It’s almost as if Lucid Motors somehow obtained access to Tesla’s technology and broke into their facility and stole their secret plans for a new model vehicle.

Also Read: Coal Crisis and the World

Market capture

Lucid Motors claims that it will be the first to produce the

Tesla Model 3. The company has been preparing for production in earnest, and they unveiled their prototype, which is made in part from carbon fiber and aluminum, earlier this year. It is also much cheaper than a Tesla Model 3 at about $700 for the base model.

The Lucid Motors market is currently in turmoil with investors and board members debating whether or not to continue funding the production of its pricey sedan: the Air. As it stands today, Lucid Motors may never make a reliable budget car like its competitor Tesla has done so many times before with its Model S series of vehicles.

The Tesla Model 3 may be the best vehicle on the market because it is both affordable and highly functional. Tesla’s strategy has allowed it to put many electric cars on the road. The company plans to build 500,000 cars by 2018. It could sell more than 1,300,000 cars by 2020 if it wanted to do so. The company plans to start manufacturing the Model 3 in 2017, which could make it an even bigger competitor for Lucid Motors.

The Lucid Motors market simply does not have the cash flow at this time to compete with Tesla or other manufacturers looking to get into the electric car business.

Tesla and lucid Motors-Financial standing

Lately, both companies have been posting financial results that make the stock market excited. However, their results – and their respective growth rates – are not without significant differences. Tesla is a company with a history of success in the automotive industry while Lucid still has a lot of work to do before it can be considered successful. Despite these differences, both organizations have great potential for future success and will continue to see an increase in investor confidence going forward.

Recent events

Lucid Motors, an organization that is developing a future electric model with fully autonomous driving capability, has seen its share price double in value since the beginning of 2017. This rise in stock price matches the rising demand for investors to see Lucid succeed. The company’s near-future goal is to deliver a vehicle with autonomous driving capabilities, but Lucid has yet to show any images of their car.

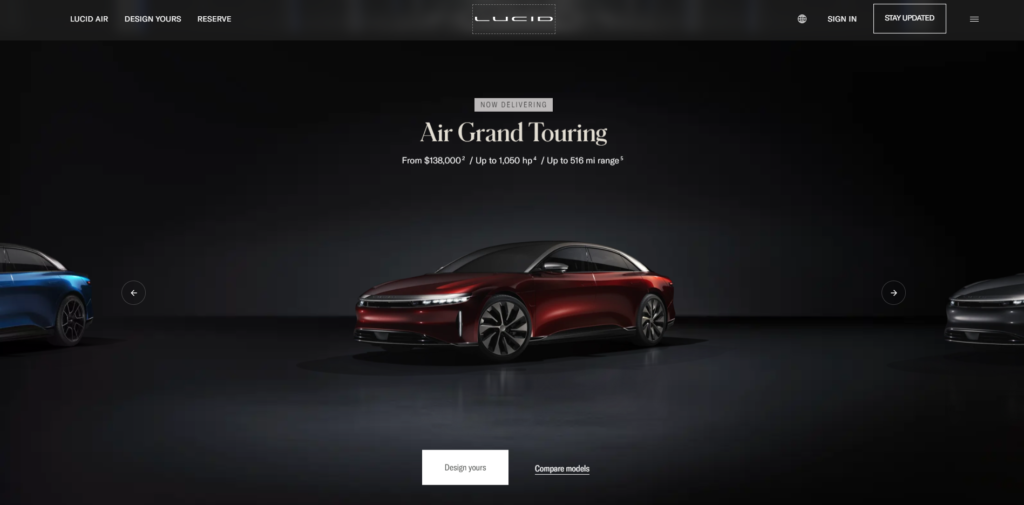

Lucid Motors car with the name ” Air “

Considering this information, it seems odd that most analysts are excited about Lucid’s future prospects. This is not to say that they are incorrect, but more than most auto industry experts do not know exactly what they are expecting from Lucid Motors. This produces a level of uncertainty that is not expected by many investors.

What investors are asking for?

These issues are not limited to Lucid Motors. Investors have another company in their eyes, Tesla. Tesla is a car manufacturer that has generated an incredible amount of interest from investors. Their stock price has quadrupled since the end of 2015, which has generated a great deal of excitement within the marketplace. This rise in interest followed the public release of their mass-market Model 3 vehicle, which generated over 300,000 pre-orders during the first 4 days after it was revealed.

1 Comment